Abdulrahman Ibrahim Moalim Gedi

Sunday November 8, 2020

BRIEFING PAPER

November, 2020

Abdulrahman Ibrahim Moalim Gedi

(Abdulrahman Samow)

Debt Management Consultant, Debt Management Unit

Ministry of Finance, Federal Government of Somalia

Table of Contents

I. Synopsis

II. Background and Structure of Somalia’s External Debt

III. International Financial Institutions (IFIs) Re-engagement, IFIs Arrears Clearance and Reform Lessons

IV. International Financial Institutions (IFIs) Arrears Clearance

V. Paris Club Creditors Traditional Debt Relief “Cologne terms”

VI. Concluding Remarks, Possible Scenarios for further Debt Relief & Full Debt Cancelation

I. Synopsis

In this paper, I lay out the debt relief and debt cancellation processes beyond the Paris Club traditional debt relief, and International Financial Institutions arrears clearance that Somalia will endure over the coming twenty-four months. I explain the sequencing and interlinkages between the relevant creditor stakeholders, including the Paris Club, Non-Paris Club and Multilateral creditors. The underlying objective is to support the Somali government’s development of a robust external debt management strategy.

II. Background and Structure of Somalia’s External Debt

Somalia is a country emerging from devastations caused by a prolonged twenty- plus years of civil war that shattered the nation’s people, economy, institutional systems, and infrastructure. It is now slowly recovering as progress is being made in rebuilding the economy and important institutions to transition Somalia from fragility and to stability. The challenges ahead are enormous and require substantial financial, economic and technical effort and support. Part of these challenge is a legacy of external debts accumulated by Somalia’s former governments in the 1980s. This left the country with a huge debt burden and placed it into the category of Heavily Indebted Poor Country. External public debt as of December 31, 2019 stood at approximately US $ 5,3 billion (107% of GDP) of which nearly 96 percent (96%) is in arrears. This means that most of the debt has matured and the Somali government has not been able to service it or pay it back in time.

Access to new external financing is crucial for economic recovery and reconstruction efforts in Somalia. Development financing is the bridge that will allow Somalia to transition from fragility to social and economic stability and then progress. However, the country’s external debt overhang, and its large stock of sizeable arrears from both bilateral and multilateral creditors, compounded by the constrained fiscal space, restricts access to critical financial resources in both the global commercial and concessional loan markets. The restrictions mean heightening negotiations that give rise to debt restructuring and/or cancellation in order foster reconstruction and development of Somalia. This happens through negotiations with the respective creditors under the Highly Indebted Poor Countries (HIPC) Initiative. This Initiative was launched in 1996 by the International Monetary Fund (IMF) and World Bank, with the aim of ensuring that no poor country faces a debt burden it cannot manage.

The Federal Government of Somalia began working toward debt restructuring and cancellation through series of IMF-supported programs in mid-2015. The government’s robust and tight adherence to the IMF programs have yielded some dividends - earning international trust and increase in donor grants to important support reform programs. External debt contracted by the former government was used for Public Investment Programs and Balance-of-Payments (BoP) support. A significant portion was also used to finance government’s military equipment from the 1960s through to the late 1980s. During the 1980s, Somalia faced difficulties servicing its debt, resulting in two rescheduling agreements in 1985 & 1987 with the Paris Club creditors. Nonetheless, Somalia’s outstanding external debt continued to rise, reaching an unsustainable 277% of GDP when the central government collapsed in 1991.

At the end of fiscal year 2019, Somalia’s public external debt was estimated at US $ 5,3 billion (see Table 1), equivalent to 107% of the GDP. Somalia has a total of 27 confirmed creditors that are divided into three categories: Multilateral, Paris Club and Non-Paris Club. It is important to note that Somalia’s external debt data is in the process of reconstruction and validation as the government has undertaken a broad range of efforts in collecting and validating the external debt data through seeking any evidence of claims from all creditors. To date, 98% of Somalia’s external creditors provided loan by loan debt data including copies of loan agreements to the Debt Management Unit (DMU) of the Ministry of Finance of FGS.

Table 1: Somalia’s external public debt as of December 31, 2019 (millions of US dollars).

III. International Financial Institutions (IFIs) Re-engagement, IFIs Arrears Clearance and Reform Lessons

The IMF re-established relations with the Federal Government of Somalia on April 12th, 2013 following continuous reform efforts and strong foreign policy engagements delivered by the Federal Government of Somalia. In 2015, Somalia activated its membership of the IMF after 24-years of suspension and by requesting an Article IV country surveillance consultation. The IMF accepted and a strong relationship built on the implementation of fiscal reforms began.

The IMF’s Article IV agreements concerns the obligations of member countries on the regular surveillance of a country’s economic and financial developments, and exchange arrangements intended to identify weaknesses and provide policy advice. Somalia requested the IMF’s support in developing a strategy toward eventual debt relief, including, from the IMF. Given Somalia’s substantial economic development needs, it was agreed that the strategy should involve a comprehensive reform plan to avoid falling back into future debt traps - post-debt relief. The IMF, in 2015, nominated a Resident Representative for Somalia to boost cooperation between the Fund and Somalia.

The Federal Government of Somalia has undertaken series of IMF Staff Monitored Programs (SMPs) since May 2016. They were informal programs agreed with the Fund management that provided opportunities to build Somalia’s track record of cooperation on macroeconomic policies by setting structural benchmarks and quantitative targets to be observed and achieved.

The SMPs focused on the implementation of prudent macroeconomic policies while strengthening institutional capacity for macroeconomic management. The main objective was, and remains, to support economic growth by enhancing governance and economic statistics, strengthening fiscal discipline, rebuilding capacity for monetary policy implementation, and fostering financial sector development.

The successful completion of four-12-month SMPs provided the basis for a move to a formal IMF arrangement. In March 2020, the IMF’s Executive Board approved a three-year arrangement under the Extended Credit Facility (ECF) and the Extended Fund Facility (EFF) for Somalia in the amount of SDR 292.4 million (about US$395.5 million or around 179 percent of quota). The IMF-supported program aims to support implementation of reform agenda and catalyze concessional donor financing. It additionally aims to help the country implement its National Development Plan to build greater economic resilience, promote higher and more inclusive growth, and reduce poverty. More importantly, the approval of the arrangement signaled Somali’s full re-engagement with the international community and the international financial system .

In conjunction with the approval of the IMF-supported programs, the Fund and the World Bank's International Development Association also determined that Somalia had taken the necessary steps to begin receiving debt relief under the enhanced Heavily Indebted Poor Countries (HIPC) Initiative. Somalia became the 37th country to reach this milestone, known as the HIPC Decision Point.

IV. International Financial Institutions (IFIs) Arrears Clearance

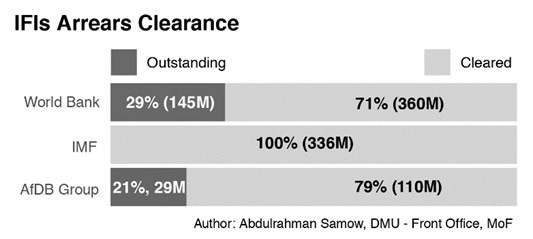

Arrears to International Development Association (IDA) of the World Bank were cleared on March 5th, 2020 through bridge financing provided by the government of Norway, reimbursed with the proceeds of a Development Policy Grant.

Arrears to the IMF were cleared on March 25th, 2020 with the assistance of bridge financing from the government of Italy which the authorities have reimbursed using the frontloaded access under the new IMF financial arrangement.

Arrears to the African Development Bank Group were cleared on March 2nd, 2020 through bridge financing provided by the government of the United Kingdom and a contribution from the European Union. The bridge loan from the UK was reimbursed by the proceeds of a Policy Based Operation Grant.

V. Paris Club Creditors Traditional Debt Relief “Cologne terms”

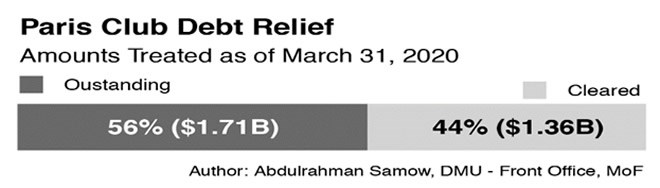

The majority of Somalia’s external official bilateral debt is owed to Paris Club states, approximately two-thirds of Somalia’s external debt is held by Paris Club creditors. The Paris Club creditors that Somalia has outstanding debts with are USA, Russia, Italy, France, UK, Spain, Japan, Denmark, Norway and the Netherlands. Following Somalia reaching the HIPC Decision Point, the representatives of the Paris Club creditor countries agreed on March 31st, 2020 with the Government of the Federal Republic of Somalia to restructure its external public debt after extensive day long negotiations. This was the first ever “virtual” negotiating meeting of the Paris Club. I was part of the Somali delegation led by His Excellence Minister of Finance Dr. Abdirahman D. Beileh who held this successful and historical first ever virtual negotiating meeting with the respective Paris Club Creditors. The negotiation was concluded under the so-called agreement “Cologne terms,” which aims to provide interim debt relief conditional on the country continuing to make good progress under the HIPC Initiative. This led to the immediate cancellation of debts owed to the Paris Club creditors not related to developmental assistance amounting to US$ 1.4 billion. The remaining outstanding amount will be addressed for a full debt cancelation when Somalia reaches HIPC Completion Point and successfully implemented the benchmarks of the current Extended Credit Facility Program along with the completion point triggers.

VI. Concluding Remarks, Possible Scenarios for further Debt Relief & Full Debt Cancelation:

Reaching Decision Point on March 25th, 2020 has further significance for Somalia because the reforms under the successive IMF SMPs strengthened good governance and transparency in the country. Despite the country’s ranking as one of the most corrupt nations globally, the crucial reforms undertaken by successive Somalia governments under the IMF reforms which included biometrically registering all security personnel, paying civil servants directly into their bank accounts on time and addressing corruption within the public sector, have won the confidence of both Somalis as well as the international community. Now, the attainment of debt relief after a difficult long reform journey with still some way to travel to full debt cancellation from all creditors after Completion Point, now fuels the Somali authority’s determination to maintain this positive momentum and satisfactorily implement key reforms agreed at the Decision Point.

The next milestone for Somalia will be the Completion Point, where Somalia will receive the full amount of HIPC debt relief committed at Decision Point. At this stage, the Net Present Value (NPV) of debt is expected to be less than 10 percent of GDP. For Somalia to reach Completion Point, Somalia will need to fulfill the following criteria; a. To establish a further track record of good performance under ECF/EEF program, b. Implement Poverty Reduction Strategy for at least one year, c. Implement the floating Completion Point triggers. If Somalia successfully implements these criteria, it is expected that, at the Completion Point, Somalia’s debt will be reduced to sustainable levels. Full debt relief for Somalia will open access to a full range of resources that will help address poverty, job growth for the youth and other development projects that are much needed in Somalia.

Debt distress is difficult for all nations but its effects are more extreme when a country is as fragile as Somalia and unable to pay any of it to creditors. However, through the continued efforts in economic and financial reforms across Somalia, the Somali people’s awareness of the importance of these for their future and the vast resources of the country, we can imagine a day without debt burden for Somalia.