Friday May 8, 2020

By Samuel Getachew

REUTERS/TIKSA NEGERI

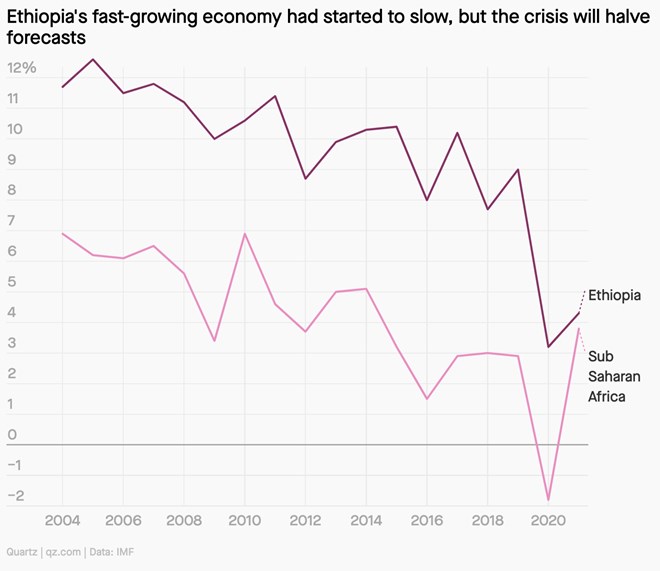

Ethiopia’s once promising economy has run into a wall as the global economic crisis unleashed by the coronavirus pandemic devastates the nation of more than 100 million, forcing IMF to slash its GDP growth forecast for 2020 down to 3.2% from 6.2%.

The Horn of Africa country, home to the continent’s second largest population, had been on a decades-long reform which had seen the country overcome its years of economic upheaval and famine during the 1980s under the Marxist Derg regime, to become one of the world’s fastest-growing nations this century. The country’s economy grew by an average of 10.8% between 2004 and 2014.

At the start of 2020, Quartz Africa noted the one-time miracle economy was slowing and set for a bumpy ride, but the economic crisis in the wake of the pandemic will undoubtedly be much more challenging and may even unravel some of its developmental progress as a nation as its growth slows significantly.

Ethiopia’s Jobs Creation Commission has estimated close to 1.4 million workers will be affected by the pandemic, particularly in the service and manufacturing sectors. There’ve been reports some of its industrial parks, often highlighted as a model for other African countries to follow, have started laying off workers due to a slump in global demand. Ethiopia’s strategy of attracting foreign investment to these parks with a mix of tax-free benefits, free land and subsidized electricity, will prove very expensive if factories and parks remain closed.“The economic impact of the Covid-19 pandemic for Ethiopia is staggering,” says Alemayehu Geda, an economics professor at Addis Ababa University. He predicts the pandemic could shrink Ethiopia’s GDP by as much as 11.1% through 2020/21. Ethiopia’s fiscal year runs from July 8 to July 7.

Manufacturers, including metal and garments factories, are struggling to stay afloat as importing raw material has become very difficult due to disruptions of global sourcing. while importers are reporting losses as they are forced to suspend business travels to major suppliers in China, which accounts for a quarter of Ethiopia’s imports.

Tourism, which had around 10% share of GDP in 2018, accounted for nearly half of all the country”s export revenue, driven by Addis Ababa which is the diplomatic capital of Africa and Ethiopian Airlines. The airline has been a source of immense pride for Ethiopians as it’s rapidly expanded to become Africa’s biggest airline over the last decade.

But like airlines around the world Ethiopian has been hit significantly by the crisis and has already reported $550 million in lost revenue over the last two months and furloughed some workers and laid off others, as it begins to focus on cargo to sustain the business through this period. In 2019, it posted annual revenues of $4.2 billion.

An urgent appeal for food assistance has reached a record high of 30 million people, according to Ethiopia’s Planning Commission and the agricultural sector has been

impacted due to locust invasion which has managed to destroy 350,000 metric tons of crops. The government expects the agriculture sector is also likely to lose $838 million.

“Beyond its impact of health, it is crashing our economy. Exports of goods, especially by horticulture producers and garments from industrial parks, is falling unprecedentedly, causing economic distress,” said Ahmed Shide, Ethiopia’s finance minister. “It has also a huge impact on government revenues and remittance flows.”

Though Ethiopia is one of a few Sub Saharan Africa countries believed to be more susceptible to the spread of coronavirus early on, so far, with just 162 cases it has one of the lowest confirmed case loads, especially relative to its population size.

But analysts warn the economic impact will be much worse because many smaller businesses are yet to lay off the majority of employees and the collapse of the all important informal sector could reverse years of progress in reducing poverty.

In the meantime, prime minister Abiy has started to trying to raise $2.1 billion from international lenders and bilateral partners. This week, Germany, one of the most visible allies of Ethiopia’s ambitious developmental goals extended $130 million to help salvage the economy and allow the government to extend tax initiatives to businesses hit by the pandemic.

Debt relief

Abiy has been one of the most strident voices among elected political leaders in Africa to call for wealthy countries to either forgive or delay debt payments through op-eds in international media or speeches. Its debt-to-GDP ratio around 62% at the end of its fiscal year in June 2018 is about the Sub Saharan Africa average of around 60% in 2018.

But the IMF and World Bank are concerned about the “risky” composition of the debt because the share of external debt owed to bilateral official and private creditors is nearly 60%. The World Bank also notes Ethiopia’s public external debt service is up to 25.3% of national exports, which is the highest debt service-to-exports in Sub Saharan Africa.

Last month the World Bank stepped in with an $82 million in anti-pandemic support and this week the IMF approved $411 million in emergency assistance and approved Ethiopia’s request for a suspension of debt service payments of about $12 million to the IMF. The funds will be used to support low-cost lending and rescheduling loans to businesses whose incomes have been severely affected, says Fikadu Digafe Huriso, chief economist of the National Bank of Ethiopia.

Banks are now working under tight liquidity position as non-performing loans mount due to the economic slowdown. Businesses, through their associations, have been calling on the government to push for the extension of their loans.

“It will be important to encourage spending by ensuring the supply of adequate liquidity to the financial system,” says Fikadu. “This measure has to be supplemented by adequate foreign exchange resources to revitalize both imports and exports.”