Moneyweb

Tuesday, October 11, 2016

By Ray Mahlaka

The continent is still fertile but short-term headwinds make investors jittery

Africa is fast becoming a battleground for hotel investments as investors are lured by opportunities on an increasingly under-supplied continent with growing tourism and a rising middle-class.

Investor sentiment into Africa’s hotels remains positive despite growing concerns about the slow-down of oil-dependent countries such as Nigeria and Angola due to lower oil prices, currency volatility and political instability.

Fuelling the optimism are the latest figures from research firm STR showing that countries such as Libya, Somalia, Congo and Central African Republic are still under-supplied with less than 500 branded rooms compared with their mature counterparts such as South Africa and Egypt, which boast more than 50 000 branded rooms.

Branded rooms are typically owned by juggernaut hotel groups such as Hilton Hotels and Resorts, Marriott International, Rezidor Hotel Group, AccorHotels and others.

Speaking at the Expo Real in Munich, STR’s head of business development in hotels James Parsons said the divergence between mature and developing hotel markets in Africa is indicative of the “very large opportunities for big branded companies to benefit and build hotels.”

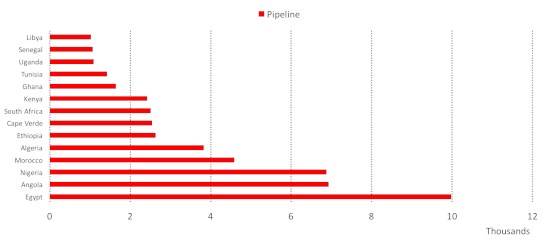

International and domestic hotel counters are ramping up their investments as STR’s August 2016 research indicates that Egypt has a pipeline of ten thousand rooms that will be supplied – cementing it as a hotel investment hot spot in Africa.

Source: STR

“It’s a healthy pipeline of hotels in sub-Saharan Africa despite the market being difficult,” said Parsons.

South Africa and investment flows

South Africa is only ranked eighth with the country’s hotel industry considered to be tough and saturated by market watchers. Also, the remnants of the 2008 global financial crisis and the subsequent end of the 2010 Fifa World Cup left the industry with a massive hangover in subsequent years.

And yet more hotel investors continue to place their bets in the country. US-head quartered Marriott International announced last week that it is planning to spend R3 billion on five new hotels in South Africa mainly in Johannesburg and Cape Town.

Another counter with ambitious expansion plans is hotel group Carlson Rezidor, the operator of branded hotels such as Radisson Blu and Park Inn. The company’s executive vice president and chief operating officer Olivier Harnisch said 32 hotels are in the pipeline in sub-Saharan Africa. Of the pipeline, 17 hotels are planned to open in the next two years.

The focus markets for the new hotels will mainly be South Africa, Nigeria, Kenya and Ghana.

Carlson Rezidor entered the African continent in 2001 and now operates 37 hotels.

Harnisch said South Africa has been a boon for the group, particularly in Cape Town and Johannesburg. “With that said there is still lots to be done in terms of branded hotels in the continent,” he said.

You don’t have to look far for reasons behind hotel investments: sub-Saharan Africa’s economic growth (forecasted to grow by 3% in 2016 according to the International Monetary Fund) and a rising middle-class giving rise to consumerism. These dynamics have also paved the way for the growth of business and leisure travellers – indicative of what is dubbed by many observers as “Africa Rising.”

Hotel returns

Hotel investments in Africa have been a good bet and investors have been coining it.

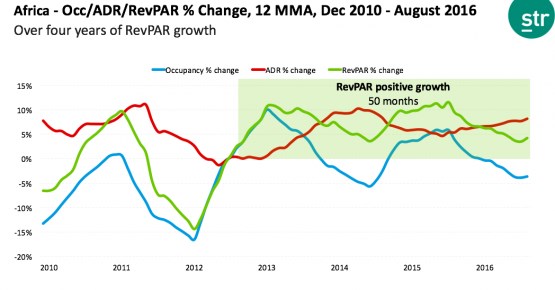

According to STR, the average daily room rate (ADR) and revenue per available room (RevPAR) – key metrics used by the hotel industry to measure the profitability of hotels – grew by 8.6% to US$103 and 4% to US$56 in the year to August respectively.

Although the rewards are apparent, investors need to be mindful of risks such as poor land ownership rights framework, political instability, bureaucracy in getting real estate projects approved and customs regulations in the continent.

Selim Bora, the chairman of property development firm Summa, said investors still need to take a long-term view in Africa. “One country can be safe today but dangerous tomorrow. GDP growth rates are high in Africa compared with the global average. Real estate projects do take time in Africa and you need the patience,” said Bora.

The writer was Messe München’s guest at the Expo Real in Munich, Germany last week.